Individuals whose application histories are less than optimal are always given the opportunity to submit their application. Because of this, you will need to have an official invitation in order to use this credit card.

It is common practice for First Savings Bank to issue invitations to high-risk clients in order to assist them in establishing a credit history.

Button

or

Button

There is a possibility that you might still be approved for this card from First Savings Bank of Beresford, South Dakota, even if your credit is not particularly exceptional. In the event that you have damaged your credit score and are unsure of how to repair it, continue reading.

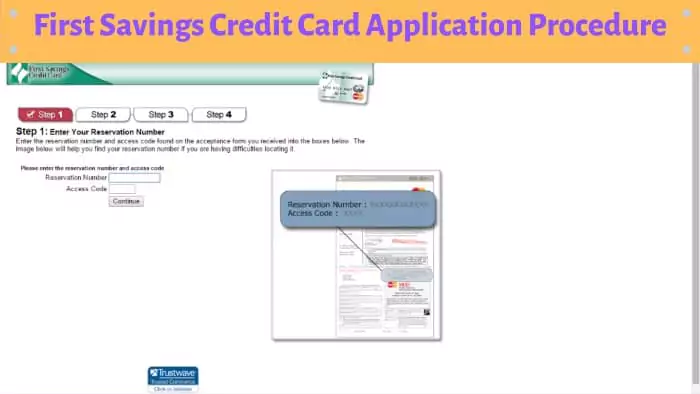

Steps For Registration At Firstsavingscc.com

Once you have received an invitation offer, you are eligible to submit an application for the First Savings Credit Card. In order to do this, you will need to complete out an application that is organized in a basic manner. The only thing that is expected of you is to follow the directions that are provided here.

- To access the website of First Savings Bank, go to the following address: www.firstsavingscc.com.

- Please choose the “ACCEPT ONLINE” option, which is described as being green in color, in order to continue.

- The application form that may be found on the following page must be submitted by you according to the requirements. Initially, in the first box, you will need to enter your reservation number. After that, you will need to enter your access code in the second field. To proceed, choose the Next option.

- You are going to be required to enter and verify your postal address on the page that follows these instructions. To proceed, choose the Next option.

- Immediately once the application has been completed, it will be available to you. You must now complete it in its full, including all of the necessary information, as it is now expected of you. Last but not least, press the “Next” button.

- In conclusion, before you can accept the offer, you must first read the terms and conditions that are associated with it and then click the “Accept” button. Make sure you send in your purchase next.

- Last but not least, the only thing left for you to do is show patience as you wait for the response to your request. Following the completion of the authorization process, your credit card will be mailed to you.

Guide To FirstsavingsCC Login

The process of logging in to your First Savings credit card account is a snap after your application has been accepted and you have been given the card. In order to log in using your First Savings credit card, the following actions need to be taken:

- Visit the website www.firstsavingscc.com in order to access your account for the First Savings Credit Card.

- From the menu, choose “Account Login” to proceed.

- Simply go to this website and pick the “Account Login” option in order to get access to your First Savings Credit Card customer account.

- A username and password were provided to you when you enrolled for your First Savings credit card. You are free to use these credentials whenever you visit this website.

- Select the “Login” button once you have typed your username and password into the appropriate fields.

- If you want to access your First Savings credit card account, you will need to click the Login button once you have provided your username and password.

How To Reset Your Username And Password?

Users were able to easily regain access to their online accounts by simply changing their passwords, which was made possible by the credit card processing business.

Due to the fact that they have forgotten their login passwords, a significant number of customers who have credit cards issued by First Savings Bank are unable to access their accounts.

It is possible for you to achieve this goal if you just adhere to the simple instructions that are outlined below:

- Visit their website at www.firstsavingscc.com to browse their offerings.

- From the menu, choose “Account Login” to proceed. It is necessary to choose the “Account Login” option in order to have access to your First Savings Credit Card account.

- When you are signed into your First Savings Credit Card account, choose “Forgot my username or password” when you are requested to do so.

- Click the Continue button to proceed with the process.

- Prior to selecting the Next button, you will need to fill out the following fields: account number, expiration date, security code, and the last four digits of your social security number.

Ways To Activate Your Credit Card

The activation of your First Savings credit card may be accomplished by following the procedures that are listed below:

- To learn more, visit FirstSavingsCC.com. After going to the website of the First Savings Credit Card, which is www.firstsavingscc.com, you will need to click the “Account Login” option in order to start the activation process for the card.

- It is necessary to go to the login page and search for the option that says “Register a new user” in order to establish an account.

- When questioned, customers will be required to provide up the following information: their account number, the date it expires, their CVV, the last four digits of their CPF, their username, their password, a confirmation of their password, their email address, their telephone number, and their email address.

- You may use the option that reads “I prefer not to add my mobile number” if you would rather not have your phone number shown for calls and notifications.

- If you would like to click “I agree with the terms,” please read the whole agreement before you do so. Simply press the “Register” button.

Benefits And Features Of First Savings Credit Card

Before submitting an application for a First Savings Credit Card, a great number of prospective cardholders are interested in learning more about the card’s features and benefits.

Reviewers who have previously enjoyed the benefits of the First Savings Bank Credit Card have graciously consented to share their experiences with the program in order to make it possible for others to enjoy the same benefits that they have.

This website contains reviews and information on the First Savings Bank Credit Card, which may be accessed by those who are interested in applying for the card.

The following is a list of the benefits of FirstsavingsCC:

1. The simplicity of it

When a customer uses a credit card, they are eligible for a variety of benefits. It is important to remember that using a credit card is simpler and more convenient than using a debit card when making a significant transaction.

2. Funds That Are Currently Offered

The revolving credit that comes with credit cards is a significant benefit. Users are able to borrow up to a specific limit whenever and wherever they want it, which eliminates the need for them to continuously seek more finance.

3. Certain Credit Cards Will Have Their Fees Reduced

Because of the lower fees associated with this card, it can be a suitable option for you if you want to use credit cards but are trying to keep a close eye on your spending.

One example of this would be a credit card provider that does not impose an annual fee. When compared to other credit cards, there are those that provide more favorable interest rates than others.

Customer Service For Card Holders

Customer service centers will be established all across the United States of America by First Savings Credit Card in order to provide improved assistance to First Savings Bank clients who make use of their credit cards.

Each and every day of the week, from seven in the morning until nine in the evening Central Standard Time, our customer support line for the First Savings credit card may be reached at 1-888-469-0291.

If you are looking for customer care that is either helpful or unsatisfactory, you may contact First Savings Credit Card at any moment.

Kindly call the number that has been given above to get in touch with our First Savings credit card firm. In the event that you have any questions or concerns about your credit card from First Savings Bank, please do not be reluctant to get in touch with us.

The following is a list of all of the customer service centers that are able to accept credit cards issued by First Savings:

This is the address for both the Main and correspondence addresses:

First Savings Credit Card is a credit card.

5019 is the postal code for Sioux Falls, South Dakota, which is 57117-5019.

Where to Send Your Payment:

First Savings Credit Card is a credit card.

A Stop for Mail 2509

68103-2509 Omaha, Nebraska is the address cited.

Offers Available At First Savings Cards

The First Savings Bank provides you with five different options, each of which is determined by your creditworthiness:

Selection 1:

14.9% Annual Percentage Rate for Purchases

An interest rate of 23.9% is charged for payday loans.

There is no annual cost.

Depending on whether amount is bigger, the fees for processing transactions are either ten dollars or four percent of each cash advance. A proportion of two percent for all transactions that take place online.

Two, three, and five offers are as follows:

The annual percentage rate for purchases is 29.9 percent.

The interest rate for payday loans is 29.9 percent.

Should you decide to add a cardholder to your account, the yearly fee will rise from $75 to $20 respectively.

2% of all cash advances are included in the fees for processing transactions.

Choice number four:

The annual percentage rate for purchases is 29.9 percent.

The interest rate for payday loans is 29.9 percent.

A fee of $49 is required to be paid annually, with an additional $20 being charged for each cardholder.

2% of all cash advances are included in the fees for processing transactions.

Bill Payments And Fees For First Savings Bank Credit Card

When using the First Savings Credit Card, there are fees associated with the use of a variety of payment methods. You will find a quick overview of the commission that is charged by the First Savings credit card below, as well as the payment method that is defined by the following:

What Is the Most Effective Method to Pay Your Bills?

One of the most easiest ways to make payments is via the web site that is associated with the First Savings credit card. After you have created an account online, you will have the opportunity to set up payments to be made automatically.

Other payment methods include MoneyGram with the code 3890 or Western Union with the city/state code FSCC/SD. Both of these options are suitable alternatives.

There is also the possibility of paying with a debit card via customer service; however, there will be a surcharge of $3.95 for the processing of this transaction.

As an additional choice for making a payment using a credit card issued by First Savings, you may also use the following postal address:

The cards issued by First Savings;

The 2509th Mail Stop;

68103-2509, Nebraska, number.

Expensiveness and Costs

Before you are able to complete your purchase using this credit card, you are required to fulfill a number of conditions, one of which may include receiving an invitation. The following items are included in the pricing and fee structure:

Every year, the cost is $49

$ 350 is the maximum amount.

The annual percentage rate for purchases is 26.9%.

APR for cash advances is 29.9 percent

Annual Authorized User Fee $20.00 (this fee is optional).

You can be charged a late fee of $25.

Up to twenty-five dollars if the money is refunded.

| Official Site | First Savings Credit Card |

|---|---|

| Country | United States Of America |

| Registration Required | Yes |

| Mobile Application | Yes |

| Managed By | Mastercard International, Inc. |

Mobile Application For 1st Savings Credit Card

Any mobile gadgets, such as iPads, tablets, or smartphones, should you bring with you please? What I am doing is keeping my fingers crossed that the first Sparkasse credit card holders will have the same sentiment.

As a result of the fact that a large number of creative programmers have developed a large number of helpful applications for smartphones, we now conduct all of our day-to-day financial activities on them.

Signing up for an account with a few helpful programs that you may use for all of your day-to-day transactions is all that is required to make purchases.

Despite the fact that your credit is not perfect, you are still able to submit an application for the 1st Savings Credit Card, which is offered by First Savings Bank in Beresford, South Dakota.

The mobile payment system of First Savings Bank, which is known as the First Savings Credit Card App, was made available to the public on May 7, 2019.

Features of the One Savings Credit Card Application:

- Discover How to Make Use of Your Very First Credit Card for Savings

- You are able to log in to your First Savings Credit account from almost any location thanks to our mobile app, which provides simple access to your account. Observe your balance, view your transactions, pay your bills, and so on.

- Access to Accounts Provided in a Straightforward and Rapid Manner Data encryption Exists WithinEnsure that you are aware of when you are moving.

- Make sure that you are configured to receive notifications and that you have the ability to alter your notification settings so that you can monitor what is going on with your account.

- Whenever a payment is due or a bank transaction is recorded, you have the ability to regulate and arrange for notifications to be delivered to you when they are sent.

- Find out how to make the most of your first credit card for savings.

- You have the ability to see or download your monthly statements, as well as check your available balance and money inside your account.

- Determine when your payment is due, and then make your payment online.

- When it comes to managing automatic payments, you have the ability to add, change, or remove them.

- Make changes to your account’s contact information, including your name, telephone number, and address.

About First Savings Bank

Not only has the bank been operating for more than a century, but its headquarters are located in Beresford, which is located in South Dakota.

Our present presence extends over 22 locations in six different states. In addition to Texas, the states of Arizona, South Dakota, Nevada, and New Mexico are included in our service territories.

Because of the 1,200-mile distance that between our bank in Beresford and our bank in El Paso, Texas, there are times when administration may be difficult to manage.

For a considerable amount of time, First Savings Bank and First Savings Financial Group have been operating with the purpose of providing services to the residents of southern Indiana.

This commitment includes the First Savings Charitable Foundation as a recipient of its support. The month of October 2008 was the month when the foundation was officially incorporated.

First Savings Bank is pleased to announce the launch of MasterCard® SecureCodeTM, a free service that will improve the functionality of your existing MasterCard® account on First Savings Bank.

You are able to make purchases online at some businesses without having to worry about your credit card being used fraudulently if you have a personal security code.

In some online stores, providing your private security code is as simple as entering it when First Savings Bank asks for it. This is the case for certain online businesses. Immediately after we have verified your identify, we will go on with the transaction you have requested.

Frequently Asked Questions

The questions and their solutions are as follows:

How Does the Rental Car Insurance on My First Savings Credit Card Work?

The details of the rental automobile insurance that comes with your credit card are a mystery to First Savings Bank. Get in touch with First Savings Credit Card customer support at 1-888-469-0291 to find out more about the perks of your card.

If you use the First Savings Credit Card, how much money would you earn?

A credit card, that is. Using it to make a purchase will not earn you any benefits. The ability to gradually increase your cash is the main perk. That was it.

Conclusion

In order to effectively boost your credit score, you will need to make sure that you pay all of your expenses on time and that you do not skip any charges while using the First Savings credit card.

This article will guide you through the process of enrolling in and activating your First Savings Credit Card, as well as registering for or resetting your credentials via the online portal, paying your bills, and other related tasks.

Utilizing the First Savings credit card will be a simple process for you if you have a satisfactory credit history. There is a possibility that the interest rates, penalties, transaction fees, cash advance fees, annual percentage rates (APRs), and other terms and conditions of a credit card will vary from one card to the next.

There are no rebates or incentive programs, and the annual price and interest rate are both higher than they were before.